Multimedia Content

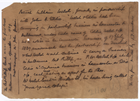

Port Phillip Bank partnership Cheque, 1840, courtesy of University of Melbourne Archives; GRIMWADE, Sir Russell and Lady Grimwade Papers 1975.0089-2002.0003.

Details

Port Phillip Bank partnership Cheque, 1840, courtesy of University of Melbourne Archives; GRIMWADE, Sir Russell and Lady Grimwade Papers 1975.0089-2002.0003.

Details

Port Phillip Bank partnership document, 1839, courtesy of University of Melbourne Archives; GRIMWADE, Sir Russell and Lady Grimwade Papers 1975.0089-2002.0003.

Details

Banking and Finance

The discovery of gold in the early 1850s was the catalyst that propelled Melbourne-based institutions to national prominence. Many types of financial institutions emerged to serve the needs of a rapidly growing Victorian and national economy. In the process the city developed a financial district centred on Collins Street west of Elizabeth Street. An influx of British capital in the late 1880s signalled the apogee of Melbourne's financial dominance. A series of bank failures in the 1890s was the beginning of the end. However, the path of decline relative to Sydney has been long and gradual. It was only in the last two decades of the 20th century that Collins Street's pre-eminence surrendered unequivocally to Sydney.

The initial pastoral occupation of Port Phillip attracted a few fledgling financial institutions. On the eve of the gold rushes Melbourne's small population supported branches of only two trading or commercial banks and a savings bank. The earliest banking services were offered in 1838 when the Hobart-based Derwent Bank and the Commercial Banking Co. of Sydney used local merchants as agents. Neither survived the entry into the Melbourne market of the British-owned Bank of Australasia and the Union Bank of Australia in 1839. The Union absorbed the Derwent's agency. The Sydney bank retreated. Melbourne had hosted the Port Phillip Savings Bank, an offshoot of the New South Wales Savings Bank, since 1842. It was renamed the Commissioners' Savings Bank in 1853.

After the inactivity of the 1840s the decade of the 1850s saw the number and character of Melbourne's banks transformed. Bankers and financiers quickly came to occupy a place of prominence. A booming economy needed credit, specialist payment services and a place for savings. The opportunities for business occasioned by the impact of gold attracted new banks. The exception was the Bank of New South Wales which opened its branch on the corner of Collins and William streets on 15 April 1851, two months before the discovery of gold in Victoria. While the Commercial Banking Co. of Sydney returned to open a branch on 17 January 1853, it had closed again within the year. This bank was not to have representation again in Melbourne until 1927.

The rest of the newcomers chose Melbourne as their principal place of business. They differed from their predecessors who, with the exception of the Union Bank, were branches of existing banks whose headquarters were in Sydney or Tasmania. The new arrivals included three British banks, the Oriental Bank Corporation, the English, Scottish & Australian Chartered Bank (ES&A) and the London Chartered Bank of Australia who set up their branches in 1852 and 1853. Despite the doubling in the number of banks between 1851 and 1853 there was room for more. Local business people opened three new banks, the Bank of Victoria (1853), the Colonial Bank of Australia (1856) and the National Bank of Australasia (1858). In a portent of the future, the Bank of Australasia transferred its head office from Sydney to Melbourne in 1860. By that year eight of Australia's 15 trading banks were headquartered in Melbourne. Of the rest three were in Sydney, two in Tasmania, and one each in Adelaide and Perth.

Melbourne's bankers were innovators in many respects. Victoria held a half of Australia's population by 1861 and nearly a third as late as 1901. This population base provided profitable business for bankers and encouraged the provision of a wider range of services. It was to the Bank of Australasia's local manager, David Charteris McArthur, that the colonial government turned for advice about its finances in 1853. The Bank of Australasia also acted as an agent for the first overseas borrowing by the Geelong and Melbourne city councils in 1854. Banks acted as advisers and underwriters of loan-raisings by all colonial governments for the next 40 years. Co-operation between the banks in their dealings with governments gave rise to an informal association in the 1850s and 1860s that acted as a forum and a mouthpiece for the industry. The informal gave way to the formal with the establishment of the Associated Banks of Victoria in 1877. This organisation, which was unique to Victoria, was the forerunner to a national body, the Associated Banks of Australia (1954). The peak industry body transferred its headquarters to Sydney in July 1999.

The growing volume of banking business and the number of banks issuing cheques led to the establishment of Australia's first clearing house arrangement in 1868. A contemporary observer, Edward B. Hamilton, described the Melbourne Clearing House in The law and practice of banking in Australia and New Zealand (Melbourne, 1900) as operating in 'a commodious hall, No. 337 Collins-street, handsomely fitted up'. Sydney banks did not operate in this fashion until 1894, not because of an insufficient volume of business but, it is alleged, because of the unwillingness of one of the larger banks to co-operate. The rules and procedures of the Melbourne body became the model for other States' clearing houses.

The character of Melbourne's banks was heavily influenced by the presence of so many British domiciled banks. In many respects the British banks, or Anglo-Australian banks as they were often known, were more experienced in international finance and foreign exchange dealings than their newer domestic competitors. Their London offices allowed them to offer a range of services to Australian customers that could not be matched by the local banks until they too began operations in the world's largest money market.

The London directors of these powerful banks often took a different view on matters both monetary and political than their own Melbourne-based executives or the directorates of the local banks. The Anglo-Australian banks spoke with a voice that reflected a City of London perspective. This often led to tensions and division within the Melbourne banking community as it was drawn increasingly into a dialogue with governments. In the interwar period in particular, the Melbourne banks and those based in Sydney took increasingly divergent positions on many issues in their dealings with the Commonwealth Government.

The influence of Melbourne banks was felt far beyond the city. Australian banks followed the British system of branch banking rather than the United States model of unit banking. Banks built their business by opening new branches. The number of trading bank branches in Victoria rose from six in 1851 to 531 in 1892. The Bank of New South Wales was still the only non-Victorian bank to operate branches in the State. Melbourne-based banks operated more than 300 branches elsewhere in Australia. The larger banks had branches in up to four or even five other colonies. Managing across such vast distances thrust these banks into the forefront of organisational innovation, delegating supervisory authority to local inspectors whose territories generally covered a colony. The best managed banks operated as bureaucracies that attempted to ensure that every member of staff in each branch followed rules set by head office. The growing administrative function was reflected in the size and design of the magnificent multi-storeyed structures built on Collins Street. While the ornate banking chambers caught the public eye, the maze of offices on the higher levels housed an unseen army of senior bank officers who administered these far-flung empires.

The economic expansion of the 1860s, 1870s and 1880s provided opportunities for new banks to be created as well as for the expansion in branch numbers of the existing institutions. The newcomers in order of their opening were the Commercial Bank of Australia (1866), Provincial & Suburban Bank (1872-79), City of Melbourne Bank (1873-95), the Australian & European Bank (1874-79), Mercantile Bank of Australia (1877-92), and the Federal Bank of Australia (1881-93). With the exception of the Commercial Bank, none of these new banks survived beyond the property boom of the 1880s that spawned 'Marvellous Melbourne'.

An expanding economy provided scope for other types of financial institutions. Economic prosperity allowed many in the community to save. Savings banks and life assurance offices provided alternatives to the interest-bearing fixed deposits of the trading banks. Victoria had two savings banks, the Commissioners' Savings Banks and the Post Office Savings Bank that began in 1865. The latter was absorbed by the Commissioners' Savings Banks in 1897 after three earlier attempts at amalgamation. The Post Office Savings Bank used its huge branch network, 370 in 1891, together with the Commissioners' 37 branches, to accumulate more than 301 000 accounts on the eve of the 1890s bank crashes. A number of life assurance companies established themselves in Melbourne: Australasian Insurance Co. (1857), Victorian Life and General Insurance (1859) and the Australian Alliance Insurance Co. (1862). None of these firms matched the size or longevity of those owned by their policy-holders or 'mutual' societies that were soon to emerge: the National Mutual Life (1869), Australian Widows Fund (1871), Mutual Assurance Society of Victoria (1871), T&G Mutual Life Society Ltd (1876), and Colonial Mutual Life Society Ltd (1877).

Gold continued to weave its spell on the city's financial institutions long after the original rush was past. The colonial government had pressed its claims for the operation of a local mint with the British authorities since the 1850s. However, the building of a mint in Sydney in 1855 undermined Melbourne's case in the eyes of the imperial government. Finally, after years of procrastination, Melbourne's Royal Mint came into being and accepted its first gold on 13 June 1872.

Establishment of the Stock Exchange of Melbourne in 1884, Australia's largest, and the erection of its splendid building at 380 Collins Street in 1891, represented the culmination of a long struggle to assert the metropolis' supremacy over rival exchanges in Bendigo and Ballarat, and the resolution of differences among its quarrelsome brokers. Trading in shares in Melbourne dates from the 1850s. The first unsuccessful attempts to form a stock exchange took place in 1857 and 1858. A Melbourne Brokers' Association made further attempts to start an exchange in the 1860s. They achieved partial success with the establishment of the Melbourne Stock Exchange in 1865. This organisation was reconstituted twice in the 1880s before it was overtaken, and later absorbed, by the new Stock Exchange of Melbourne in 1884.

The ascendancy of Melbourne's stock exchange over its colonial rivals by the 1880s owed much to the needs of the goldmining industry for new capital. That industry educated both sharebrokers and their clients in the issue of scrip, including underwriting, making a market and risk-taking. This experience and expertise was readily transferable to the silver, lead and zinc mines that were developed at Broken Hill and in northern Tasmania in the 1880s. Brokers also dealt in shares issued by banks, shipping companies, gas works, brewers and the like, and in securities placed by governments. A regular market developed that attracted many of the wealthier investors in the colony. By the 1880s the exchange dealt with securities of firms whose operations lay outside the colony of Victoria. Melbourne's stock exchange was the most important conduit for the influx of British capital that poured into the colony in the 1880s. This inflow gave rise to a speculative boom that lifted the market value of all securities from £32.5 million in 1884 to £80 million in 1889.

This influx of British capital spilt over into speculation in shares and the Melbourne property market. The rising demand for central city sites and suburban land quickly pushed up prices. But the ease with which Australian governments and banks could borrow in the United Kingdom in the later 1880s led to a great increase in credit. New specialist financial institutions emerged to participate in property development. Melbourne hosted numerous land 'banks' that engaged in speculative subdivision of land on the fringes of the city. Most of these near 'banks', none of whom issued notes or offered cheque accounts, had suspended payment by 1891 or early 1892. Building societies sprang up like mushrooms as providers of credit to home-buyers or property speculators. The Australasian Insurance and Banking Record listed Melbourne's building societies in its November 1893 issue. Of the 44 still open, 32 had been established since 1880. The collapse of the property boom after its peak in 1888 swept away most of these building societies, with unhappy consequences for their shareholders, creditors and depositors. Liquidation exposed sharp practices and fraud on the part of officers in some of the societies.

The distress suffered by the land banks and building societies as the bubble of Marvellous Melbourne burst was quickly transferred to the trading banks, with profound consequences. The Commercial Bank of Australia, which became Victoria's largest lender by the end of the 1880s, had an unusually large exposure to other financial institutions in the property market. The wholesale closures by the land banks and building societies through 1891 and 1892 raised doubts in the minds of both depositors and shareholders about the safety of the trading banks. A number of the smaller ones, the Mercantile and the Federal, had already failed before the Commercial Bank of Australia suddenly stopped payment on 6 April 1893. In the ensuing panic another six of Melbourne's trading banks stopped payment. Most reopened as 'reconstructed' banks after months of legal wrangling between customers and shareholders about their relative contributions to the rescue. More than £31 million was 'locked up' in deferred deposits and inscribed stock in 1893, nearly £8 million in 1903 and £3.6 million in 1913.

Melbourne was the epicentre of a national banking catastrophe. While the Bank of Australasia, the Union Bank of Australia and the Royal Bank of Australia rode out the storm, the collective hubris had gone. Melbourne's days as the financial capital of Australia were numbered. The loss of prestige was inexorably reinforced by the operation of more powerful economic and political factors in the longer term. Victoria was no longer the powerhouse of the Australian economy. New South Wales' economic dominance in the 20th century thrust Sydney into pre-eminence in financial matters. Her leading trading and savings banks and stock exchange came to match or surpass Melbourne's in scale and sophistication. The balance was tipped further in the favour of Sydney by the decision by the governor of the newly opened Commonwealth Bank of Australia (1912) to relocate from its temporary headquarters in Melbourne to Sydney in 1913. This important bank not only captured a large share of the nation's trading and savings bank business but it became the central bank from the 1930s. This latter role served to focus banking issues and monetary policy in Sydney. The campaign against bank nationalisation in 1947, largely directed by the Melbourne banks under the able leadership of the National's Leslie McConnan, was the city's last hurrah.

While most of Melbourne's financial institutions were slipping backwards in terms of national prestige and market share, the State Savings Bank of Victoria took its place as the city's most visible and important bank in the 1920s. By 1929 its deposits were nearly two-thirds the combined deposits of all trading banks in the state. The State Bank of Victoria spread its tentacles far and wide through a branch network that was more extensive than any of its rivals. It made an indelible mark on the moral and social fabric of the city. It was driven by high ideals to assist the poor through an encouragement of thrift. The State Savings Bank sought to inculcate the habits of saving by distributing money boxes (1908), providing school banking (1912), and running savings clubs at workplaces (1927). This remarkable bank was the first in Australia to operate a credit foncier department (1896) whose loans were funded by the sale of debentures. The use of long-term liabilities enabled it to lend for much longer periods and at lower rates to small farmers and shopkeepers, home-buyers and returned servicemen. During the 1920s thousands of Californian bungalows built with credit foncier loans came to dominate the architectural streetscapes of what were then Melbourne's outer suburbs.

With this single exception to the rule, Melbourne's financial institutions increasingly lacked any distinguishing characteristics. A process of homogenisation was hastened by a wave of mergers between 1917 and 1931 which resulted in the absorption of four of Melbourne's surviving trading banks, three by other local rivals and one by a Sydney bank. The number of Melbourne's banks was reduced further after World War II. The three surviving British banks, the Australasia, Union and ES&A, became ANZ in 1951 and Australia & New Zealand Banking Group in 1969, respectively.

The Australian financial system underwent a dramatic reshaping in the post-World War II era. Tight regulations imposed on the trading banks spurred the emergence of a new set of financial institutions in a growing economy hungry for credit. A rash of non-bank financial intermediaries such as short-term money market dealers, merchant banks, finance companies, credit unions and building societies took a growing share of the community's savings away from the banks. While Melbourne garnered its fair share of these new businesses, it was not the magnet it had been in the 1850s or 1880s. Those institutions that did set up in Melbourne lacked the street-level presence of the previous generation of banks and life offices. These new businesses, particularly those at the 'professional' end of the money market, operated far above the pavements in rented office space in the city's nondescript high-rise office blocks. They dealt with their clients by the telephone or via a Reuters screen rather than face to face in a marbled banking chamber. Even retail banking shifted towards electronic interaction in the 1980s and 1990s via ATMs, EFTPOS, credit cards and telephone banking. The number of bank branches in the Melbourne metropolitan area fell by more than a third between 1983 and 1993.

The deregulation of the financial system by the federal government in the 1980s sped up a process of cross-ownership and homogenisation that was already evident in the 1970s. New rules in the 1980s allowed the entry of foreign banks, the transformation of building societies into savings banks, and an end to the distinction between savings and trading banks. The big trading banks and life offices added to their range of subsidiaries through the acquisition of stockbrokers and funds managers. Melbourne lost more than it won in the game of swings and roundabouts. For instance, in 1982 the Commercial Bank of Australia merged with the Bank of New South Wales to become the junior partner in the Sydney-based Westpac. The National acquired the Commercial Banking Co. of Sydney in the same year, to become NAB. Melbourne was left as host to only two of the nation's four major trading banks. The proud history of the State Savings Bank came to an ignominious end in 1991 after losses by its merchant bank subsidiary, Tricontinental, resulted in its forced sale to the Commonwealth, which had outbid Westpac. Westpac made further forays into Melbourne territory by acquiring the Challenge Bank (1987) and the Bank of Melbourne (1989) in 1995 and 1996 respectively. Two other new Melbourne banks, Advance Bank (1981) and National Mutual Royal Bank (1986), were both short-lived. The former was acquired by the Commonwealth Bank in 1991 and the latter by ANZ Bank in 1990. Meanwhile, the number of Melbourne-based life offices fell to one, Colonial Mutual. National Mutual, having acquired T&G Mutual Life in 1983, was bought by the French company AXA in 1996.

The Melbourne Stock Exchange lost its unique local identity on 1 April 1987 with the establishment of a single national exchange. On that date all the State exchanges merged their assets and became wholly owned subsidiaries of the Australian Stock Exchange (ASX). This formation of a national exchange was the culmination of a long process that had its origins before World War I when the various State-based exchanges began meeting to establish common practices and procedures. The shift to centralised control of the exchange was recognition of the demands by borrowers and investors for uniform practices.

Financial deregulation in the 1980s, coupled with a strong inflow of foreign capital, encouraged banking and financial practices not seen for 100 years. Many firms made what were shown to be very poor credit decisions. Trading banks, building societies, trustee companies, finance companies, merchant banks and State banks were all caught up to various degrees in a violent property boom and bust. The failures in 1990 of the Farrow Group of companies, including the Pyramid Building Society (1959), and the merchant bank Tricontinental underscored the city's decline as the financial capital of Australia. By the late 1990s Sydney had captured the lion's share of the huge funds management market. A newspaper commentator noted that the relocation of NAB's most senior corporate banker to Sydney 'cement[ed] the drift of institutions away from the nation's traditional financial capital, Melbourne'.

- References

- Hall, A.R., The Stock Exchange of Melbourne and the Victorian economy 1852-1900, Australian National University Press, Canberra, 1968. Details

- Merrett, ANZ Bank: A history of the Australia and New Zealand Banking Group Limited and its constituents, Allen & Unwin, Sydney, 1985. Details

- Merrett, 'Paradise lost: British banks in Australia', in Geoffrey Jones (ed.), Banks as multinationals, Routledge, London & New York, 1990, pp. 62-84. Details

- Murray, and K. White, A bank for the people: A history of the State Bank of Victoria, Hargreen Publishing, Melbourne, 1992. Details